2017 saw an unprecedented Sellers market, a market correction/contraction, and the implementation of a series of new mortgage rules that had the objective of curbing the market.

Now, with the benefit of hindsight, we can see that the new mortgage rules impacted the real estate market in-so-far-as pushing Buyers to act “now” vs. post-rule change. The motivation being that Buyers were afraid they would not qualify for the home/mortgage they wanted. The impact of the new mortgage rules will be stretched as far as the 1st of May due to many potential Buyers locking in a 120 rate guarantee on the 1st of January (D-day for the stress test rules).

I predict that once we hit June we will see a similar market correction to that which we saw in 2017. I expect that market correction to continue into the fall. The exception being better than expected financial gains in the Ontario economy due to “spill over” from the U.S. thanks to their recent announcement of fiscal stimulus and the potential of better than expected NAFTA negotiations.

Local

Thus far we have see a decline in new listings as well as volume of sales. We have also found that most offers being accepted are below or near-to asking price with a few homes selling at asking price or slightly over.

We are seeing price reductions nearly every day, with the bulk of them being on properties listed above $500,000. The higher end markets have certainly contracted and will continue to do so, in my opinion, which is likely going to lead to 1st quarter (and likely the 2nd quarter) sales data headlines like “The end is Neigh” as the larger price points bring down the over-all average sale price here in the Golden Triangle and the GTA.

Prepare yourself for some sensational magazine and news paper headlines. Check out the TW Report

National

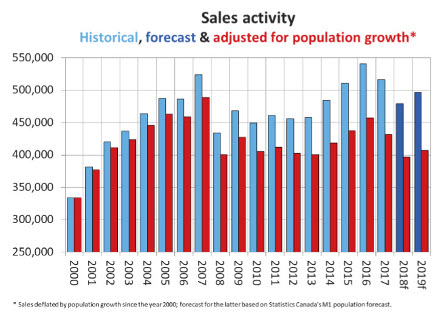

Canada is set for a positive growth year.

A strengthening economy boosted by strong global trade and exports with the added benefit of expected “spill over” from the recent announcement of U.S. stimulus spending.

Let’s not also forget the impact of increase government spending due to provincial elections here in Ontario and Quebec.

A couple of articles that make an interesting read: Monthly Economic Monitor and the Crea Monthly Highlights.

Global

The global outlook? Positive.

There are no shortage of scary headlines but it appears, from an economic perspective at least, that the global economy is doing well…albeit propped up by fiscal stimulus in numerous first world nations. It is also interesting to see the double digit gains in emerging economies like China. One can’t help but expect some positive export benefits from a growing middle class in the worlds most populated countries.